Private Coaching with Sophie

Build wealth and abundance on your terms, without sacrifice or frugality

Let’s get real for a second

You’re smart. You’re ambitious. You’ve probably read the books, listened to the podcasts, maybe even downloaded a few money templates here and there.

But your money still feels… meh.

Maybe your income goes up… but your savings stay the same. 🫠

Maybe your business is thriving… but your investments are nonexistent. 🫠

Or maybe you’re the kind of woman who has her sh*t together in almost every area… except this one.

You’re not alone.

And you’re definitely not behind.

But you are ready for your next level.

And that’s exactly where I come in.

Client win

〰️

Client win 〰️

From impulse spending to traveling in business class!

“From beginning to end, I have seen a huge shift in my attitude towards my finances.

I suffered a lot from spending guilt, and Sophie helped me create a clear system for my finances.

I have saved back the investment in the program 30 x over and I’m flying consistently in business class!”

~ Courtney, 26

I’m not here to give you another cookie-cutter budget template or tell you to “just stop buying coffee.”

This is high-touch financial coaching designed to connect the dots between your values, your income, your goals, and the habits and systems that support your wealth.

Because let’s be honest: if it were just about “knowing better,” we’d all be millionaires by now.

Let’s get into the good stuff…

By the end of our time together, you will:

💸 Know exactly where your money is going, and be proud of it.

😍 Have a clear, aligned approach to managing and growing your money that feels as good as it looks on paper.

✋🏻Ditch shame, guilt, or fear around finances, and finally feel in control.

👩🏻💻Understand how portfolios work and feel confident making your own informed investment decisions (even if you’re starting from scratch).

🥂See your money as a source of freedom, not frustration.

This is for the woman who…

Is building or running her own business and knows she needs to finally “sort out the money stuff”

Is making decent money but has no idea where it’s actually going

Feels stuck in a scarcity cycle despite doing “everything right”

Knows she’s meant to build wealth, not just stability

Wants to go beyond mindset work and actually get systems, strategies, and structures in place

Is done doing it alone

Hey there

I’m The Financial Feminist

(But just call me Sophie!)

I know EXACTLY where you are right now…

Back in 2019, despite having a great corporate income, I found myself in $6k of personal debt and constantly feeling guilty about my spending habits.

I wanted to travel and invest in experiences, but it seemed like every time I tried to save money, something would come up and I would end up taking money out of my emergency fund instead.

I was stuck in a paycheck cycle and had no idea how to break free.

I started to realize that I lacked financial education, and despite always being told to "save money," I had no idea what to do with it.

I started working at an investment firm, and that's where I learned how investing works, how portfolios are structured, and how to make informed long-term decisions with my money.

Now, after a lot of personal trial and error, I’m debt free, I fly business class from Australia to Europe and…

I'm well on my way to retiring as a millionaire.

In just 12 weeks, I can teach you my three-step framework to help you escape the paycheck cycle, pay off your debt, and start building long-term wealth with confidence.

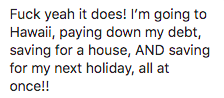

Client Win

-

Client Win -

Coaching with Sophie helped me pay for my dream honey moon in the Maldives!

“I’ve set up a better savings system, have goals for emergency fund, travel and wedding funds.

In the progress of setting up two investing streams. One for retirement and one micro investing to go towards my above goals.

I have learnt so much about investing and have the knowledge and confidence to invest. I have ideas for passive income streams!

~ Shyenne C

Coaching Packages

Coaching Packages

Coaching Packages Coaching Packages

12 months of private wealth coaching

€12,000

or €1k per month

Designed for: full-spectrum financial transformation across mindset, systems, strategy, and long-term wealth.

24 x 60-minute private 1:1 coaching sessions across 12 months

Unlimited Whatsapp or email support between sessions

Wealth Alignment Frameworks

Personalised money systems built for your real life

Long-term wealth and investing education

Done-for-you tracking systems

Investing Toolkit access

Outcome: sustained financial clarity, confidence, and wealth expansion over a full year.

12 weeks of private wealth coaching

€2500

Or €500 per month x 6

Perfect for: full-spectrum transformation across mindset, systems, strategy, and investing

6 bi weekly x 60-minute 1:1 coaching calls

Unlimited text/email support between sessions

A clear framework for saving, investing education, and building long-term wealth

Wealth Alignment Frameworks

Custom budgeting frameworks

Investing Toolkit access

Done-for-you tracking systems

Total support for 12 weeks of sustainable financial growth

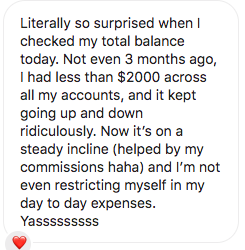

“After Sophie’s program, I’ve been able to save $10k in eight months, successfully negotiate my salary increase twice, and I’m about to become a homeowner!

~ Ariane,

What you’ll learn 👇🏼

Here’s a sneak peek of what you’ll learn in my private coaching…

-

Have you ever wondered WHY you spend the way that you do? Money is more psychological than we think. That’s why we must learn the WHY behind the spending guilt, the credit card debt and your money behaviors, the WHY will teach us HOW to improve it.

-

We’ll identify your short, mid, and long-term wealth goals and start harnessing your purchasing power to not only allocate towards building the life of your dreams, but you’ll also still be able to spend on luxury brands and weekend getaways while you’re at it.

-

Ever had the same number in your savings account for months? Well, wave goodbye to stagnant savings and say hello to a six-figure saving account. And we’re not just talking emergency funds, but luxury travel and property deposit funds too!

-

My clients leave the program understanding how to think about investing for retirement and long-term wealth, without guesswork or overwhelm.

-

The time for focusing on coupons and cheap budgeting hacks is in the past. I’ll teach you how to think WEALTHY. Healing your scarcity money mindset and re-wiring it to an abundance mindset.

-

Whether you’re working in corporate or you’re a business owner - we’re going to invite passive income and raise your income while we’re at it.

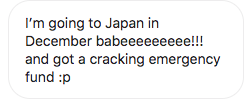

Client Win

-

Client Win -

From anxious and unclear to confidence around reaching a six-figure retirement goal!

I also feel confident about my retirement plan, investing approach, and emergency fund. Most importantly, I now see money as a tool to create the life I want rather than something to stress over.

~ Liv,

1 month coaching

Bonuses included in all private coaching plans!

“Hands down the best investment I’ve ever made”

~ Matilde, Consultant

Ready to see results like these? 👇🏼

“I cannot recommend this program enough!”

~ Kate, 32

frequently

asked

questions

-

A: This isn’t a one-size-fits-all course. This is 1:1 strategy, support, and accountability, personalised to your life, your income, and your goals. Think of it as your financial GPS.

-

A money coach is someone who helps you with fundamental financial issues. Think of it as a personal fitness trainer expert for your finances. Coaches help transform your money mindset, behavior, unconscious patterns, actions financial results, and financial planning and strategies to achieve your goals.

A financial advisor focuses on personalised investment and financial products in which they will usually take a percentage of your profits. A financial advisor can manage investments for you, a money coach cannot.

-

I do not tell you what to invest in, but I can give you the knowledge and the tools you need to become an investor and we will work together to make sure you have money in your budget for regular investing (if that is a financial goal of yours!)

-

A: Not at all. Many of my clients are business owners, but this coaching is for any woman who wants to feel powerful with her money, whether you’re self-employed, salaried, or somewhere in between.

-

A: I get it. But you’re not buying information, you’re investing in transformation. And if you do the work, this coaching will pay for itself many times over.

-

A: 100%. Many of my clients have variable income, we’ll build a system that works with that, not against it.